Residential Purchase

We aspire to provide our clients with a service that is second to none giving our clients Legal Services in a professional way and yet making it personal to suit the individual needs of our clients. We take the time to understand our clients’ needs making it our goal to provide our clients with excellent service. We are constantly striving to improve and exceed expectations. Since its inception in January 2011, our primary areas of Practice have been Property and Immigration Services in East London.

Legend Solicitors have the resources, dedication and expertise to deal with not only straight forward transactions but also complex Property Transactions. We provide cost effective legal services to individuals Purchasing residential properties.

We are Members of the Conveyancing Panels of almost all the leading Financial Institutions and therefore we are able to turn transactions around in relatively short period to meet our clients’ high service level standards. Whilst resolving any issues that arise during the course of the transaction we keep you regularly informed of developments throughout the transactions.

We take pride in saying that we have passed rigorous tests conducted by the Law Society to remain a Member of the Conveyancing Quality Scheme (CQS) so our clients can be assured that they get the best quality of conveyancing. So, we ask you to give us the opportunity of providing you our services on all your Property Matters and we are confident that we shall not disappoint you.

Get your conveyancing quote here !

Buying your home for the first time can be an exciting prospect but it can also be a mine filed if you do not have the right advice and a Solicitor to guide you through the process.

Engaging a Solicitor who is a member of the Law Society’s Conveyancing Quality Scheme for this process will ensure that your interests are safely protected.

We, at Legend Solicitors will do just that and meet the high standards set by the Law Society.

Re-mortgaging Your Home

Remortgaging is repaying your existing mortgage and replacing it with a new one. There are two main reasons for doing this:

To save money – lenders sometimes offer better deals to new borrowers than to existing ones, and by switching lender you can take advantage of this.

To raise capital – as your house price rises it can be used as security for additional borrowing, for example to purchase a second home or to extend your existing one

Equity release

The ‘equity’ in your home is the difference between its current value and any outstanding loans, such as a mortgage, secured on it.

Equity release lets you take some of the value stored up in your home either as a lump sum or gradually as a series of withdrawals over a number of years without the hassle of moving house or downsizing. It is potentially available to anyone who owns their own home in the UK over a certain value and if you are aged 55 years or older.

There are two main types of equity release, lifetime mortgages or home reversion plans. Both types allow you to remain in your home and release tax free cash to be used to bolster your retirement income or for other uses, for example, for home improvements, family gifts, purchasing car or travelling the world.

Be aware that equity release are not suitable for everyone, they can be expensive and inflexible if your circumstances change, they may affect your tax position and entitlement to state benefits and will reduce the value of your estate.

Transfer Of Equity

Transfer of Equity is where a co-owner transfers their share in a property to another co-owner. The interest can be transferred for a sum of money or it may be as part of an agreement, for instance on divorce. It is also a process when someone is either added or removed from the title deed(s), such as either a sole owner adding their husband, wife, parent, son or daughter. It is a reasonably straightforward transaction provided that all parties including any Lender or Mortgagee agree. There are circumstances when Stamp Duty Land Tax will be payable to HM Revenue and Customs. Our Conveyancing Solicitors in East London will be able to offer the professional advice you need to ensure that everything goes as smooth and stress-free as possible.

Declarations of Trust

A legally binding Declaration of Trust will safeguard financial contributions made towards the purchase or improvement of a property and can also state in what circumstances the property must be sold.

A Declaration of Trust is particularly recommended if any of the following applies to you:

- Your child is buying a property and you have contributed towards the purchase

- You and your Partner are buying a property and one of you has contributed a greater share of money whether as capital or mortgage payments

- You have spent money in improving someone else’s property so that the property has become more valuable

- You have loaned money to someone else to enable them to buy a property.

- You are buying a share of a jointly owned property

- You anticipate the property may be let so that you derive rental income from it

- One of the joint owners may vacate the property either on a temporary or long term basis

Declarations of Trust are very useful documents when two or more people buy property jointly together. It will set out each owner’s share in the property. It also sets out the rights and obligations of each owner in relation to the property, for example, relating to payments of outgoings and mortgage contributions. The document details what should happen if one owner wishes to “walk away” from the property. In those circumstances, the opportunity is given to the remaining owner to buy out the share of the owner who wishes to leave. If a “buy-out” is not possible then the property is placed on the open market. The Declaration of Trust can detail how the property’s open market value should be determined in the event of any disagreement. The proceeds of sale of the property would then be distributed to the owners in the shares as recorded in the Declaration of Trust.

There are two different ways in which property can be owned when purchased jointly; either as ‘joint tenants’ or ‘tenants in common’. Both mean that the property is owned by both parties together but the way it is viewed in law is very different.

- Joint Tenants

If you own a property as joint tenants, then you each own the whole of the property together. If one of the owners were to pass away, the property would continue in the name of the surviving owner or owners. This happens regardless of the terms of the Will. - Tenants in Common

If you own a property as tenants in common, you each own your own distinct shares in the property. This allows you to divide up the property into shares, which can be 50/50, 60/40, or whichever proportions you agree between you. Your respective shares in the property will pass in accordance with the terms of your Wills. If you decide to own a property as tenants in common it is extremely important that you consider putting a Will in place.

Commercial Property

We take the time to understand our clients’ needs making it our goal to provide our clients with excellent service. We are constantly striving to improve and exceed expectations. Since its inception in January 2011, our primary areas of Practice have been Immigration and Property Services.

Our Solicitors in East London have the resources, dedication and expertise to deal with not only straight forward transactions but also complex Property Transactions. We provide cost effective legal services to individuals leasing or Purchasing commercial properties.

Please call us to discuss any issue you may have in respect of commercial leases and we shall be pleased to assist:

Purchase Conveyancing Process

Searches

1. Local Authority Search.

The Local Search gives details of the

- Planning history

- check the current and previous owners have not done anything contrary to planning laws.

- Checks if road is maintained by the Local Authority or is private Road

- Checks on proposals for new roads

- Details of new railway development.

- Provides information about the Council’s plans for the area, If the property is in a conservation area, a smoke control zone and much more.

2. Water and Drainage.

Water and Drainage Search reveals

- Property is connected to mains water supply and mains sewerage.

- Locations of the nearest public drains and sewers.

- A public sewer or drain underneath or close to the property

- Allow Water Authority access repair or replace their pipes.

- Presence of a water meter on the Property

3. Environmental Search.

Environmental Searches

- Reveal local businesses that may have licences to discharge pollution into the air or into local rivers.

- Local businesses or authorities who have licences to hold radioactive materials.

- If the property is in a natural floodplain

- If the soil is such that it may be at risk from subsidence.

- For a use that may have contaminated the land. (over the last 130 years)

4. Chancel Search.

The Chancel Check reveals

- Potential Chancel Repair Liability on the property.

- If the subject property is in a parish within the vicinity a medieval church

- If there is a liability to contribute to the cost of repairs to the chancel of that church.

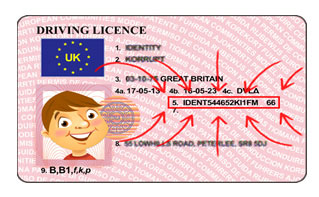

Anti Money Laundering Checks

AML Search is an electronic anti-money laundering service that enables you to verify an applicant confidently in minutes against multiple, approved and independent data sources to establish your identity.

Documents Required

Or

Plus

Utility Bills in your name within the last three months

Our Panel Membership Includes

IMMIGRATION

IMMIGRATION  CONVEYANCING

CONVEYANCING  LITIGATION

LITIGATION  FAMILY LAW

FAMILY LAW